After a thorough review, Creative Pension Trust’s Board of Trustees have decided to change the investment options available to members of our Creative Workplace Pension plan. If you’ve just received a communication about this from us, this page will explain more about the changes, what they mean, and the options you have.

What’s Changing?

In 2022, Creative Pension Trust became part of Cushon Group, a leading UK provider of workplace savings, investments and pensions. Since then, we’ve been working with Cushon Group to update your investment options.

We will shortly move you from your existing investment in one of our Target Date Funds to our new, enhanced Target Age Funds.

Alternatively, you can choose from our new range of investments and select these online – details are provided below.

The content of this page is relevant to you if you’re in our Creative Workplace Pension plan. If you’re not sure, you can find the name of your plan displayed prominently at the top of the page when you log in to the Creative Pension Trust Member Portal.

About Cushon

Cushon Group is a provider of workplace savings, investments and pensions. They operate throughout the UK and Northern Ireland. They also manage the Cushon Master Trust which, like your current pension scheme with Creative Pension Trust, is chosen by many employers to help members save for the future.

In 2022, Creative Pension Trust and Creative, sponsor of Creative Pension Trust, became part of the Cushon Group. Cushon owns a number of national workplace pension schemes including Cushon Master Trust and Workers Pension Trust.

Your Existing Investment

Today, your pension pot with us is invested in a Target Date Fund. A Target Date Fund manages your money in a way that’s tailored according to the time left until your intended retirement date – the target year.

Target Date Funds can be a good choice for people that may want flexibility in how and when they draw their pension in the future. For example, because many people now prefer to continue working part time into their retirement years, they may want to keep their pension invested for use in later life while they are still earning some income from employment.

Summary of Changes

How Your New Target Date Fund Works

How Your Money Is Invested

Summary of Changes

Members who have been wholly invested in one or more of our existing Target Date Funds will automatically be moved to our new and enhanced Target Age Funds. These funds work similarly but offer some key additional benefits:

They provide greater diversification

Your new fund(s) will allow for a wider range of investments in future. This means you are more likely to see consistent investment returns over the longer term because your money is spread across different kinds of investment, reducing the risk of big ups and downs.

They focus on growing your pension pot for longer

Your pension pot will be invested for growth until 7 years before the target year. Once you are within 7 years of this, your investments will gradually shift each year to investments aimed at preserving the pension pot you’ve built up. Today, your Target Date Fund(s) begins this process from 35 years before the target year and changes more gradually.

They reduce the impact your pension has on the environment

Through careful design, the underlying investments we use in the growth phase of our Target Date Funds:

- Deliver a 60% reduction in scope 1 and 2 CO2e emissions

- Are committed to achieving an 80% reduction in CO2e emissions by 2030*

- Reduce exposure to oil and gas by 90%*

- Will invest in companies that contributing towards climate solutions

*compared to equivalent investments that do not take their impact on our climate into account.

Your existing Fund Management Charge of 0.75% will not change.

How Your New Target Date Fund Works

Each Target Age Fund is titled after its intended retirement year. For instance, the Cushon 2030 Target Age Fund is designed for members planning to retire around 2030. These funds are offered in five-year intervals.

Our experts formulate an investment plan based on your age and the number of years to your retirement date (stated in the fund name). The aim is to maximize growth over time.

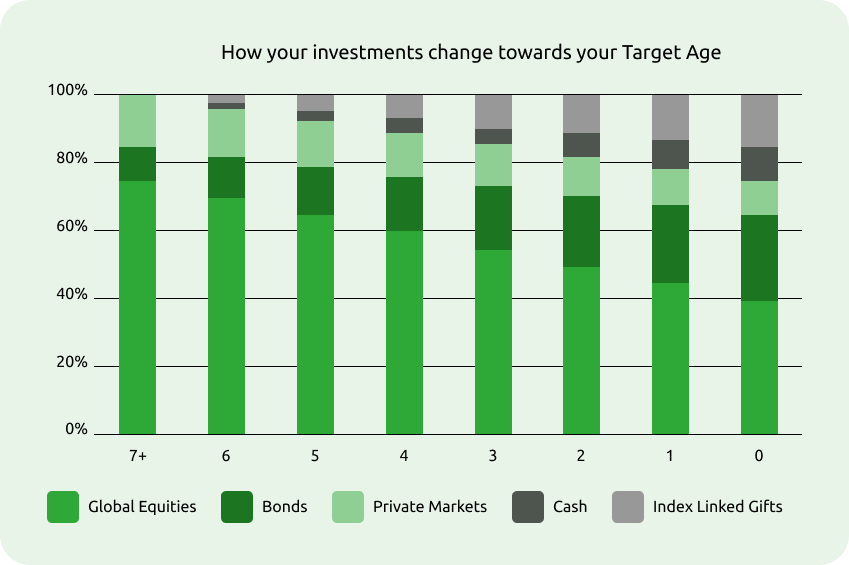

In the early years, the goal of your Target Age Fund is to increase your savings, also known as the growth phase. As you get within 7 years of your target age, the way your fund is managed starts to adjust automatically, a phase we refer to as the glidepath. The aim is to begin safeguarding your pension from significant market fluctuations.

To find out which Target Age Fund you’re invested in, log in to the Creative Pension Trust Member Portal. Click on ‘Your Pension’ and ‘Manage Investment’ on the left menu. Your fund will be shown under the ‘Your current investment allocation’ section.

How Your Money Is Invested

Until 7 years before your retirement, your pension will be invested in a diverse mix of global stocks, bonds, and private market investments. These investments are chosen for their potential long-term growth.

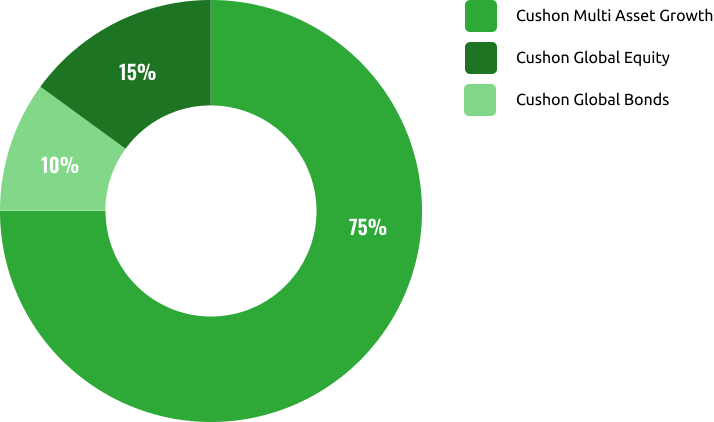

We also take into account how these investments positively impact the environment, people, and society. This is called ‘responsible investing’ and is a key feature of our Target Age Funds. Our investment managers are chosen for their strong support of these considerations. Your money will be invested across 3 funds:

- Cushon Global Equity – 15%

We look to invest in low carbon emitting companies to help the transition to a low carbon economy, both in developed and emerging markets. We align these to the United Nation’s Sustainable Development Goals. - Cushon Global Bonds – 10%

We use a number of leading managers who oversee global bond portfolios that carry a low carbon bond mandate and a social impact mandate. - Cushon Multi-Asset Growth – 75%

We invest in things like renewable energy, sustainable transport, clean technology, forestry, energy infrastructure, as well as a range of low carbon emitting companies.

Glidepath Target Investments

Once you’re 7 years away from your desired retirement date, we will begin making adjustments to the way your money is invested. The goal is to safeguard the value of your pension pot from major fluctuations in the market.

Once you reach your desired retirement date, your pension will still contain a diverse range of global equities, private markets, bonds, government bonds, and cash. This is a safer blend of investments meant to continue providing modest growth.

There are no guarantees, and the value of your pension pot can still go down as well as up at any point, but this should help avoid any larger ups and downs in investment markets.

This chart illustrates the changes made to your pension’s investments during the seven-year adjustment period leading up to your desired retirement date.

What Do You Need To Do?

I’m happy for Creative Pension Trust to move my pension pot to the new Target Age Fund.

You don’t need to do anything. This change will take place automatically and everything will be taken care of on your behalf. We will write to you to confirm when these changes will be made, either by email or post.

Just so you know, you can always change your investments with us at a later date if you change your mind.

I’d like to review my options.

Because you are wholly invested in one of our existing Target Date Funds, we will automatically move you to our new, enhanced equivalent.

However, if you no longer feel this is right for you, or you want to look at the other options available, you can download the Investment Choices Guide for your plan below.

You can select your own investments using the Creative Pension Trust Member Portal.

Getting financial guidance or advice

Moving to your new Target Age Fund(s) will affect how your current pension pot and any future contributions are invested. It will also change the level of risk associated with your pension invesments. We encourage you to review your pension on a regular basis and seek guidance and advice on all your retirement savings. Here are some options:

MoneyHelper: You can obtain guidance and more information about workplace pensions from www.moneyhelper.org.uk, which is a government service that offers free, impartial guidance. Alternatively, you can call MoneyHelper on 0800 011 3797.

Independent financial advice: You can also get advice from an independent financial adviser, though you may have to pay for it. To find an adviser near you visit: https://www.moneyhelper.org.uk/en/getting-help-and-advice/financial-advisers/choosing-a-financial-adviser.

Risk Warnings

When you invest, there are always associated risks that you need to be aware of.

Investment risk

This is the risk that the value of your pension may go down as well as up. As with all investments, you may get back less than you paid in.

It’s important to remember that your pension value can go down as well as up, even as you get closer to your Target Age.

We will automatically move some of your investments to ones that are considered more cautious as you get closer to your Target Age to help protect the value of your pension from the bigger ups and downs in investment markets. However, we cannot offer any guarantees.

Liquidity risk

This is the risk that some investments cannot be sold as quickly as others.

To give your pension the opportunity to grow for the long term, we invest in a range of different types of assets. These include assets known as ‘private market’ investments, which means they are not listed on regulated markets, such as stock exchanges. For example, this may include investments in physical assets like housing, infrastructure, energy production and natural capital.

This means some of your pension investments will be less ‘liquid’ than others, meaning they cannot be bought and sold as quickly as traditional investments like stocks and shares. Whilst this makes them suitable for supporting the long-term growth of your pension, it also means there may be, on very limited occasions, a waiting period imposed on cashing in your pension e.g. transferring your pension or taking your pension in one lump sum at short notice.

Investment objective risk

This is the risk that the Cushon Sustainable Investment Strategy might not meet its investment objectives which could mean your savings outcomes are not realised.

The Cushon Sustainable Investment Strategy has been designed to meet the needs of most of our members, but this doesn’t mean that it is suitable for your particular savings goals or that it will meet its objectives. It’s important that you review your investments to make sure they align with your future plans.

Financial guidance and advice

Your choice of pension investments can have a big effect on your pot value at retirement. If you are in any doubt about which fund is right for you, you should speak to a financial adviser.

Help accessing your account

Below you can find some useful information regarding your account.

How do I find my username?

You’ll receive your username by email after you join us and make your first contribution. If you can’t find your username, you can retrieve it through the Creative Pension Trust Member Portal log-in page.

How do I retrieve my password?

If you’ve forgotten your password, it can be reset from the Creative Pension Trust Member Portal log-in page. You just need your current username and to be able to answer one of your security questions.

How do I unlock my account?

For security reasons, your account will be locked if you make five unsuccessful attempts to log in. You can contact us to request that your account is unlocked.

You May Also Be Interested In...

My Account

Get help with managing your account and using The Creative Pension Trust Member Portal.

Popular Right Now

Here are the pension questions members are asking at the moment.

Understanding Your Pension

Take control of your pension, understand how it works and the choices you have.

More on what you can do in the Creative Pension Trust Member Portal:

- Updating your contact information – To keep us connected and ensure we can reach you, be sure to check your home address, telephone number and personal email address are up to date.

- Nominating your beneficiaries – Look after loved ones by telling us who you’d like to benefit from your savings if you die before taking them.

- Changing Investments – If you want to change how we invest your money, you can easily make a new selection online.

- Generating a statement – You don’t need to wait for an annual statement – you can produce one instantly at any time.

- Getting a retirement pack – If you’re over 55, you can access the retirement area and generate a retirement pack, which provides all the options for drawing your pension.

- Seeing your pension savings balance – We provide daily updates on the value of your pension savings, which you can log in to view anytime.

- Tracking, tracing and combining your old pensions – Make it easier to manage your savings and get a better grasp of your future plans using our online transfer process.

- Telling us your planned retirement age – Help us help you. If you don’t want to retire at 65, you can let us know so we can take this into account with your statements and how we invest your savings.

- Building a personalised financial plan – See how you’re progressing towards the retirement you want and put the plans in place to make it happen.

Want to see what other resources are available within the Creative Pension Trust Member Portal?