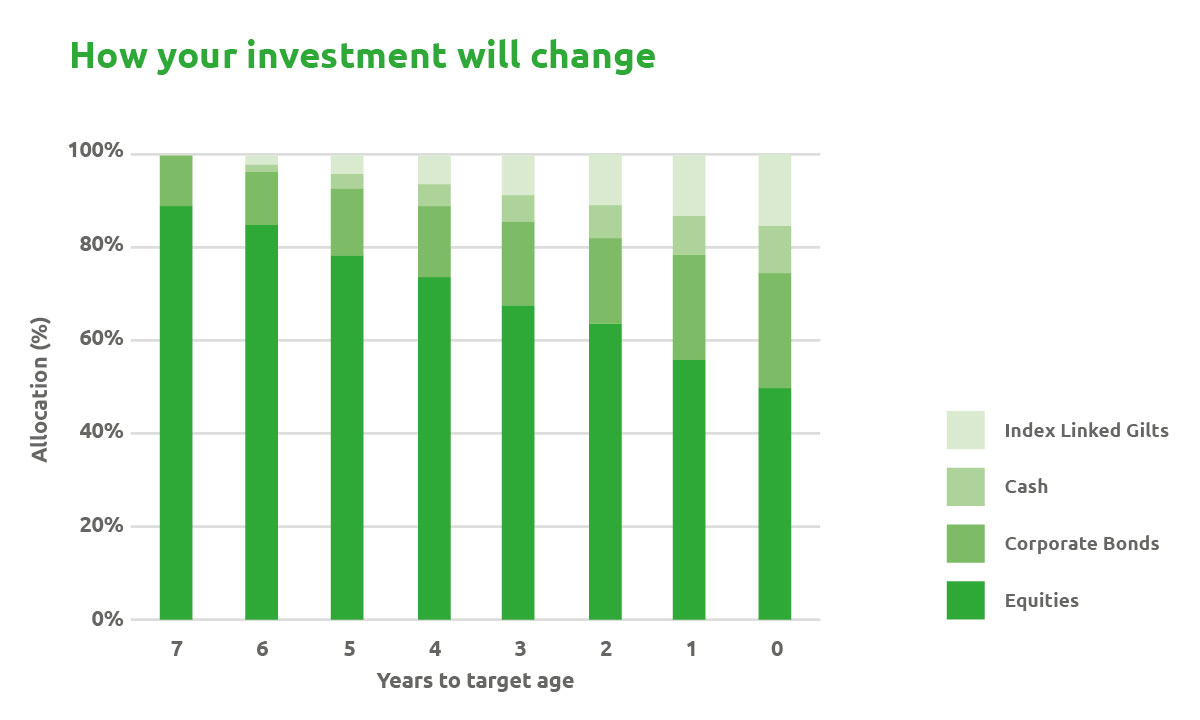

A default investment strategy like Cushon Core is designed to grow your money over the long term in a sustainable way.

While you are younger, and until you get to within 7 years of your Target Retirement Age, your pension pot is invested in a well-diversified mix of global equities and bonds. These investments are chosen to provide long-term growth potential.

When making investment decisions, our Trustees also consider how the organisations issuing these investments positively impact on the environment, people and society. This is called responsible investing and is an important element of Cushon Core. Our investment managers have been selected because they offer strong support for these considerations.

Want to learn a little more?

This short video can help clarify what happens to your money when you pay into a pension with Creative Pension Trust: