We’ve added a host of new features to our payroll portal to make managing payroll processes easier and more secure than ever.

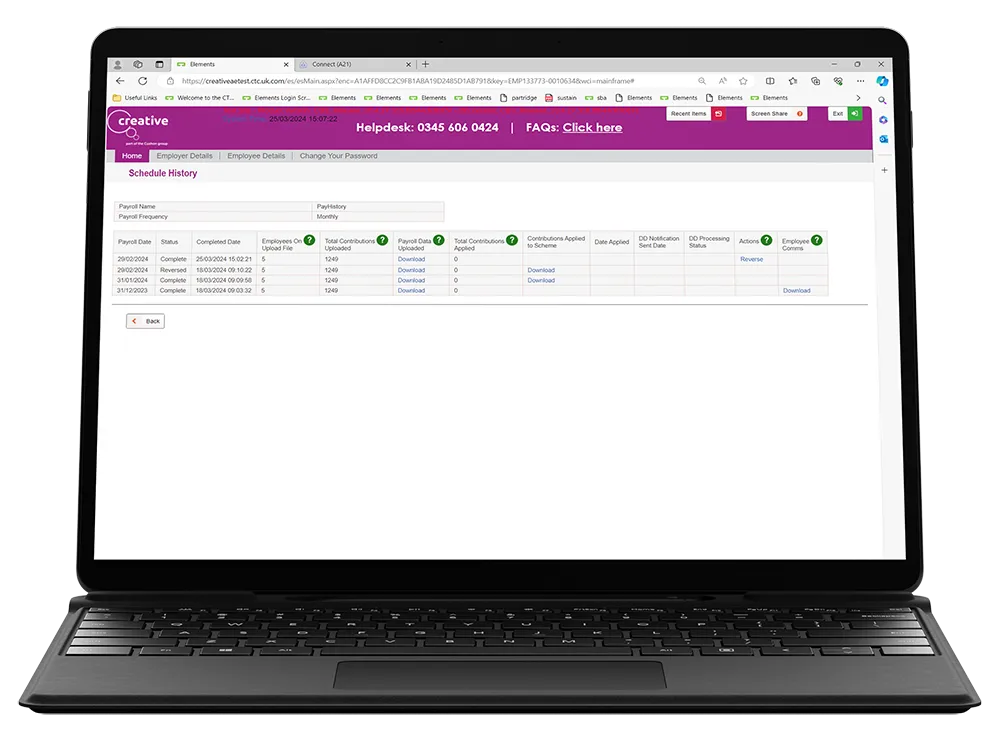

Exploring our new Payment History function

This new feature provides a comprehensive overview of all your recent and historic payroll uploads. You can access it easily via the ‘Payment History’ tab at the end of each payroll workflow.

What can you do with the Payment History function?

The Payment History function is designed to make your payroll management more efficient. You can use it to:

How to reverse a payroll upload

We’ve added a new ‘Reverse File’ function under the Actions column.

This feature allows you to ‘undo’ an upload so you can correct any data if required.

This option is only available within three days of the payroll upload being submitted. If you discover any errors with the data submitted after this period, don’t hesitate to contact our Helpdesk Team for assistance on 0345 6060424.

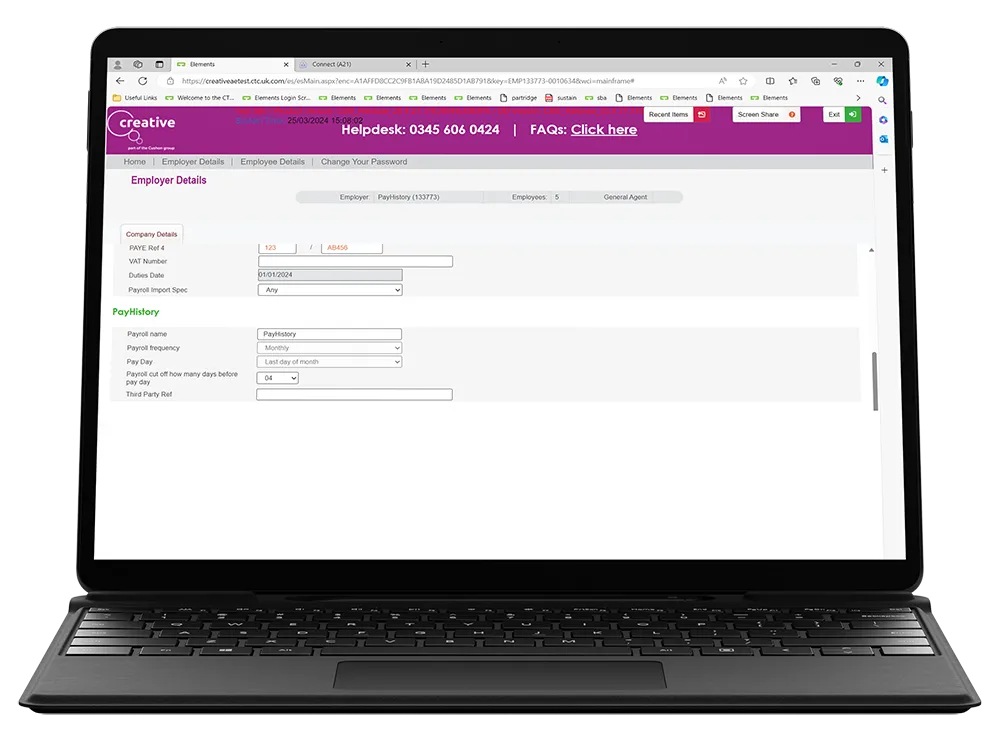

Adjusting payroll cut-off days

We’ve also added the ability for you to amend the payroll cut-off date via the Employer Details tab. This feature allows you to determine the number of days before the pay date in which a file can be uploaded.

Opt-outs and re-enrolment

In line with legislation, employees who have opted out within 12 months of the scheme re-enrolment date are not required to be re-enrolled back into the scheme. If you’d like to implement this within your scheme, please contact us and we’ll arrange this for you.

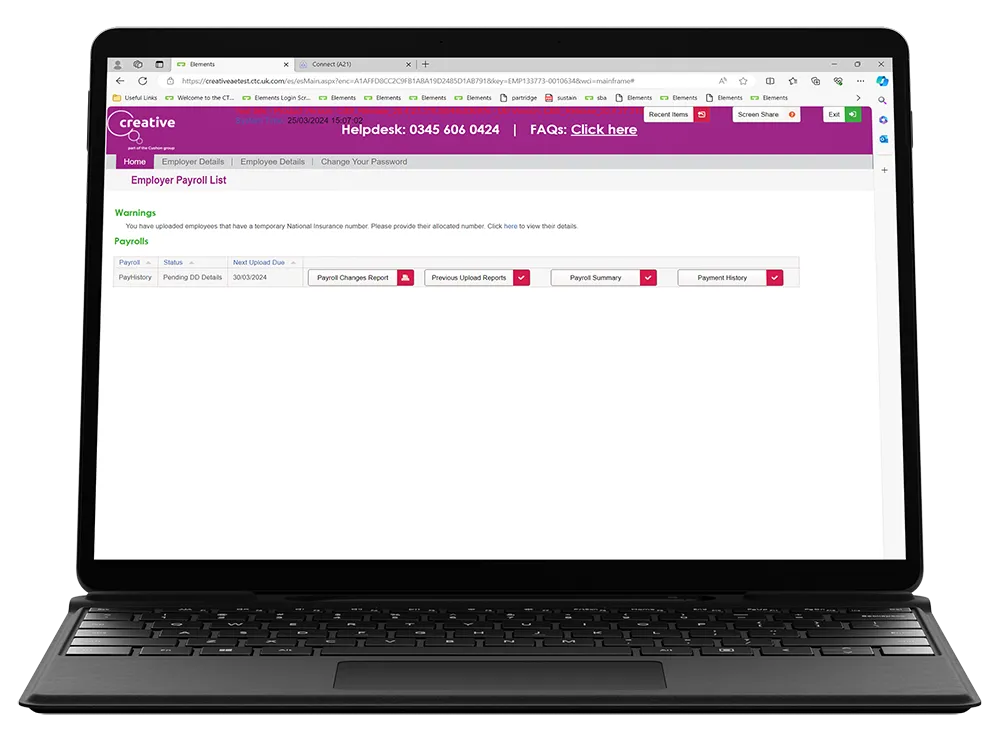

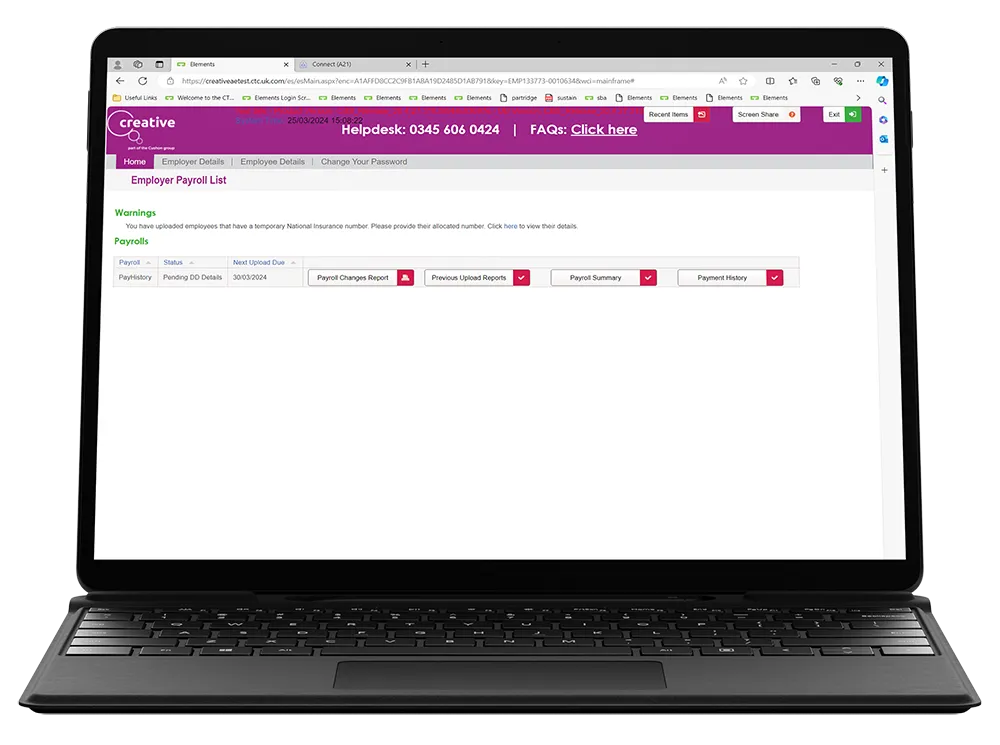

Temporary NI numbers

Keeping up-to-date and accurate data for employees is crucial. We’ve made this easier by providing a report that highlights any active employees uploaded with a temporary National Insurance Number.

This report will be shown at the top of each page in your payroll workflow(s) if applicable.

Strengthening password security

To enhance the security of our platform, we’ve updated our password requirements. The next time you’re prompted to change your password, you’ll need to create a password that meets the following criteria:

Remember, we’re here to help. If you have any questions or need assistance, don’t hesitate to reach out to our Helpdesk Team.