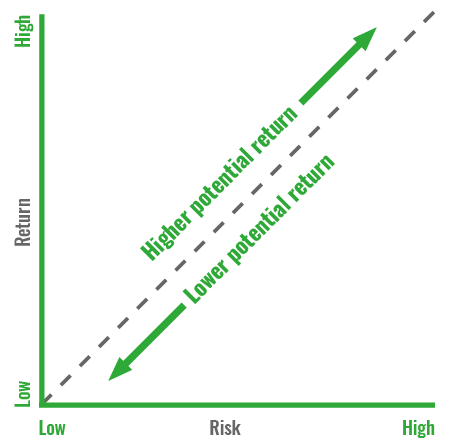

For this reason, it is important to understand what level of risk you are comfortable with compared to the potential reward.

As with all things in life, investing your money always comes with some level of risk.

Balancing investment risk with growth potential

Generally speaking, the higher the level of risk associated with an investment, the higher the potential gains. However, this goes two ways: a higher level of risk can also mean greater losses when an investment doesn’t pay off.

So, when you invest, it’s important that you are comfortable with the level of risk being taken with your money in exchange for the potential return you could make from good investments. If you’ve ever heard the term ‘risk versus reward’, that’s really what it means.

Your guide to the information on this page

More information

Want to know how we invest your money when you pay in? Watch this video to learn more about our Default Investment Strategy, which we will use to invest your money unless you decide to make your own choice of investment fund:

Risk versus Reward

Because your money with us is invested into a portfolio of different investments, all of which carry their own levels of risk versus reward, understanding the overall level of risk we are taking in order to grow your retirement nest egg is also important.

Unless you have made specific investment choices of your own, you’ll be invested into our Default Investment Strategy. With this option, your money is invested automatically. In earlier years, your money is invested in a way that gives it the opportunity to grow through investment returns. Then, once you get nearer to your Target Retirement Age, your investments gradually change. These changes aim to reduce large fluctuations in the value of your pension as you approach the time you might want to start accessing your money.